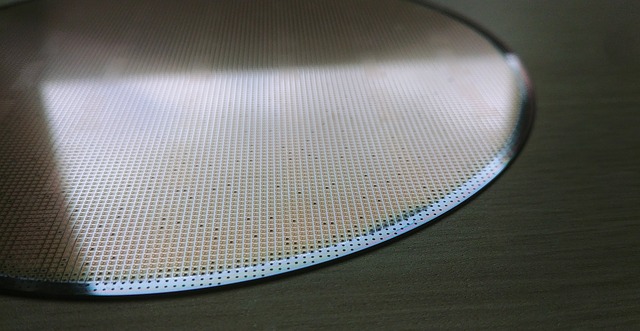

Semiconductors are materials that can behave as conductors or insulators depending on the environmental conditions. They are very relevant materials since they are the basis for the emergence and development of modern electronics (the transistor) and for the manufacture of integrated circuits. Hence the importance of the semiconductor industry.

Semiconductor Industry Applications

Today, electronics is used to solve problems and satisfy human needs of all kinds: entertainment, communications, medicine, transportation, energy… And we could go on indefinitely. There is practically no sector that can develop without making intensive use of some kind of electronic application and, therefore, of semiconductors.

The semiconductor industry, as a concept, refers to the entire ecosystem related to the material itself and to electronics. That is, it encompasses everything from the supply of the semiconductor material to the design of higher-level electronic integrated circuits, including semiconductor foundries and mass production, among other activities.

Major Companies in the Semiconductor Industry

The semiconductor industry is huge. The main companies in the sector are multinationals with thousands of employees and billions of dollars in turnover.

On the other hand, it is a technological sector in continuous evolution. As a result, the list of companies with the highest market capitalization can fluctuate.

At the time of writing, the largest semiconductor companies are: TSMC, ASML, Intel, Nvidia, Qualcomm, Texas Instruments, Broadcom, AMD, Micron Technology and Applied Materials.

The following link explains the main operations of these companies:

Encyclopedia of Semiconductor Companies.

How to Invest in the Sector

The simplest and most obvious option is to invest in shares of publicly traded companies in the sector. This method has the advantage that there may be companies, initially little known, that end up having exponential growth. However, the disadvantage is that finding such unicorns is very difficult. And the greater the risk, the greater the chances of losing money.

Another less exciting, but also less risky way is to invest in financial products that replicate indexes that track the sector. For example, the MVSMCTR index tracks the major semiconductor companies by not allowing any one of them to represent more than 10% of the index. In other words, the index represents the growth of the sector as a whole on an aggregate basis. This way the investment has less exposure to the potential sharp declines of individual companies. This link shows several ETFs (exchange-traded funds) that replicate this or other indexes of the semiconductor sector.

Disclaimer of Liability

It is important to emphasize that the author neither encourages nor discourages any type of investment. Any monetary operation carried out will be the sole and exclusive responsibility of the reader.

Subscription

If you liked this contribution, feel free to subscribe to our newsletter: